Growth Property

This option suits those who are prepared to accept a higher level of risk to achieve greater returns over the longer term. As a result, the value of your investment may rise or fall in the short term. This option is designed to provide higher levels of risk to the Balanced Essentials and Balanced Property options, and potentially higher returns.

Investment Strategy

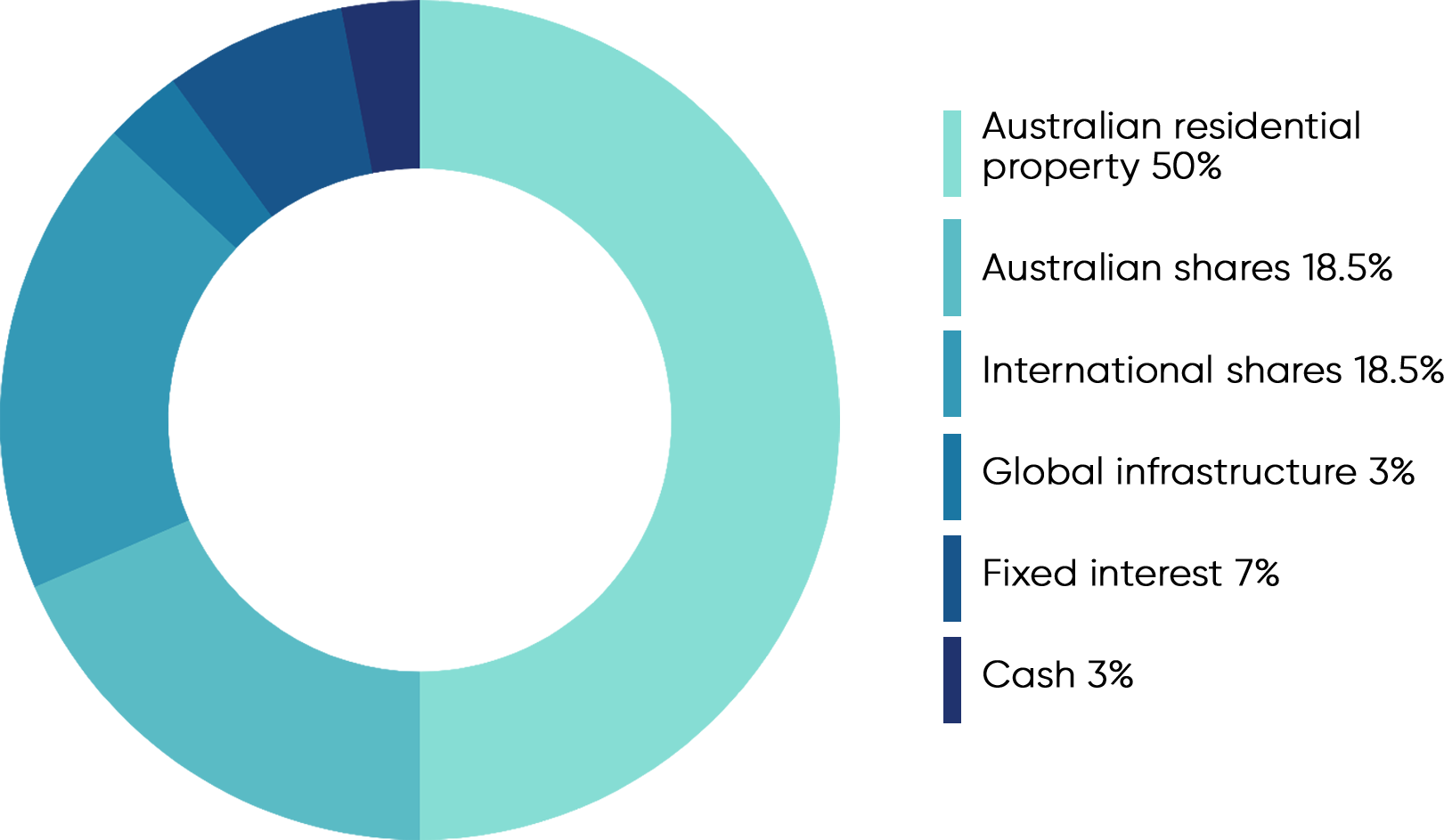

Growth Property has a strong bias towards growth assets, such as Australian residential property, Australian and international shares with a smaller offsetting allocation towards defensive assets such as fixed interest securities and cash.

Investment Objective

The Superestate Growth Property investment option aims to generate relatively high returns in the medium to long term. The return objective is to outperform CPI + 3.0% over rolling 10-year periods.

Minimum suggested time horizon: 10 Years

Level of investment risk: 5

Risk

Label: Medium to high

Probability

of a negative return: 3 to less than 4

in 20 years

Investment fee: 1.018% pa

Admin

fee: 0.84% pa + $1.27 per week

Buy/Sell

Spread: 2.30%/1.06%

Indirect Cost

Ratio: 0.055% pa

These asset allocations may not be reflected in a particular portfolio at the time when you are selecting an investment option due to a possible temporary deviation from the stated asset allocations in these investment options.