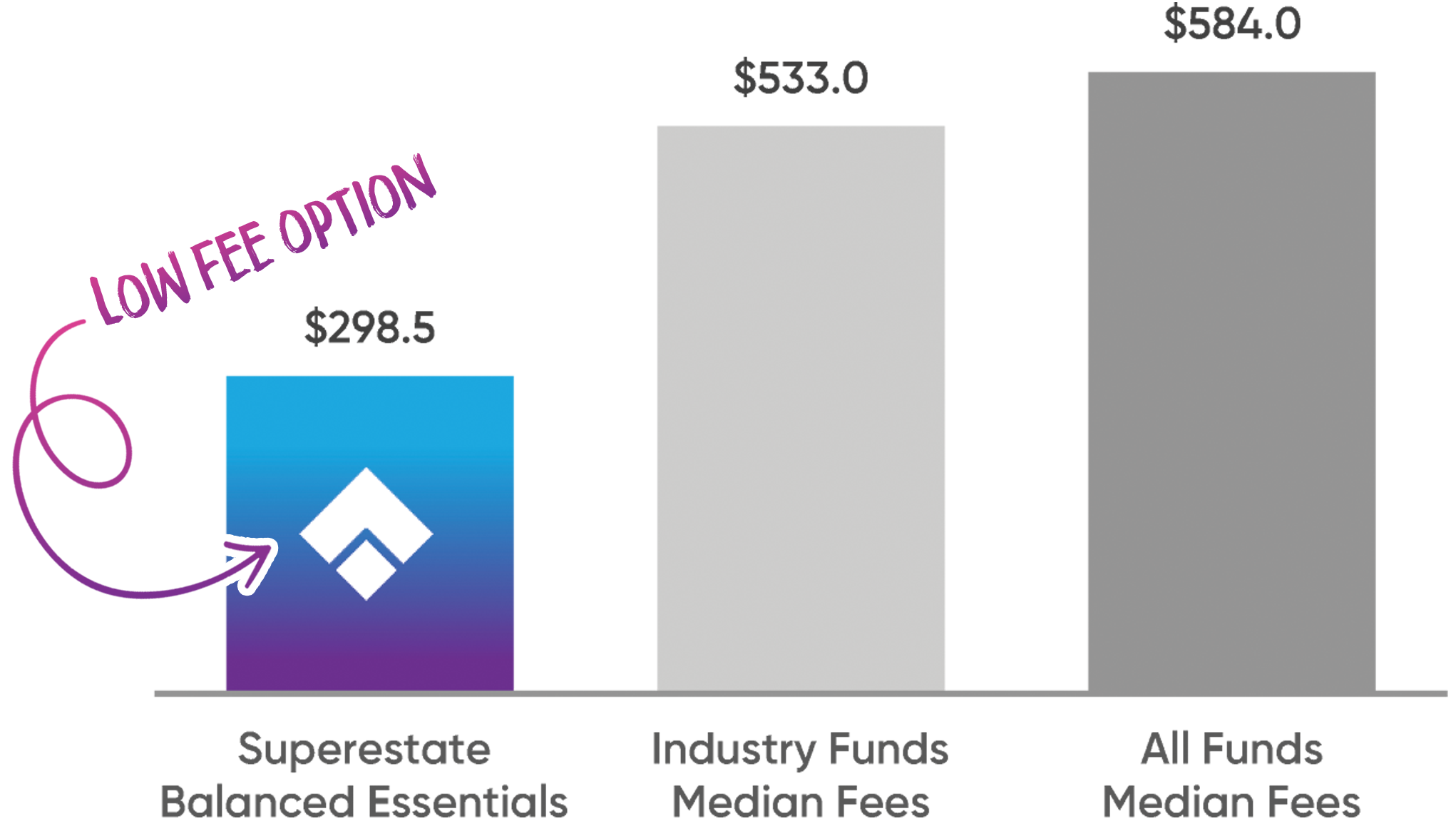

LOW FEE OPTION

Superestate Balanced Essentials offers members one of the lowest fees among balanced investment options in the market.*

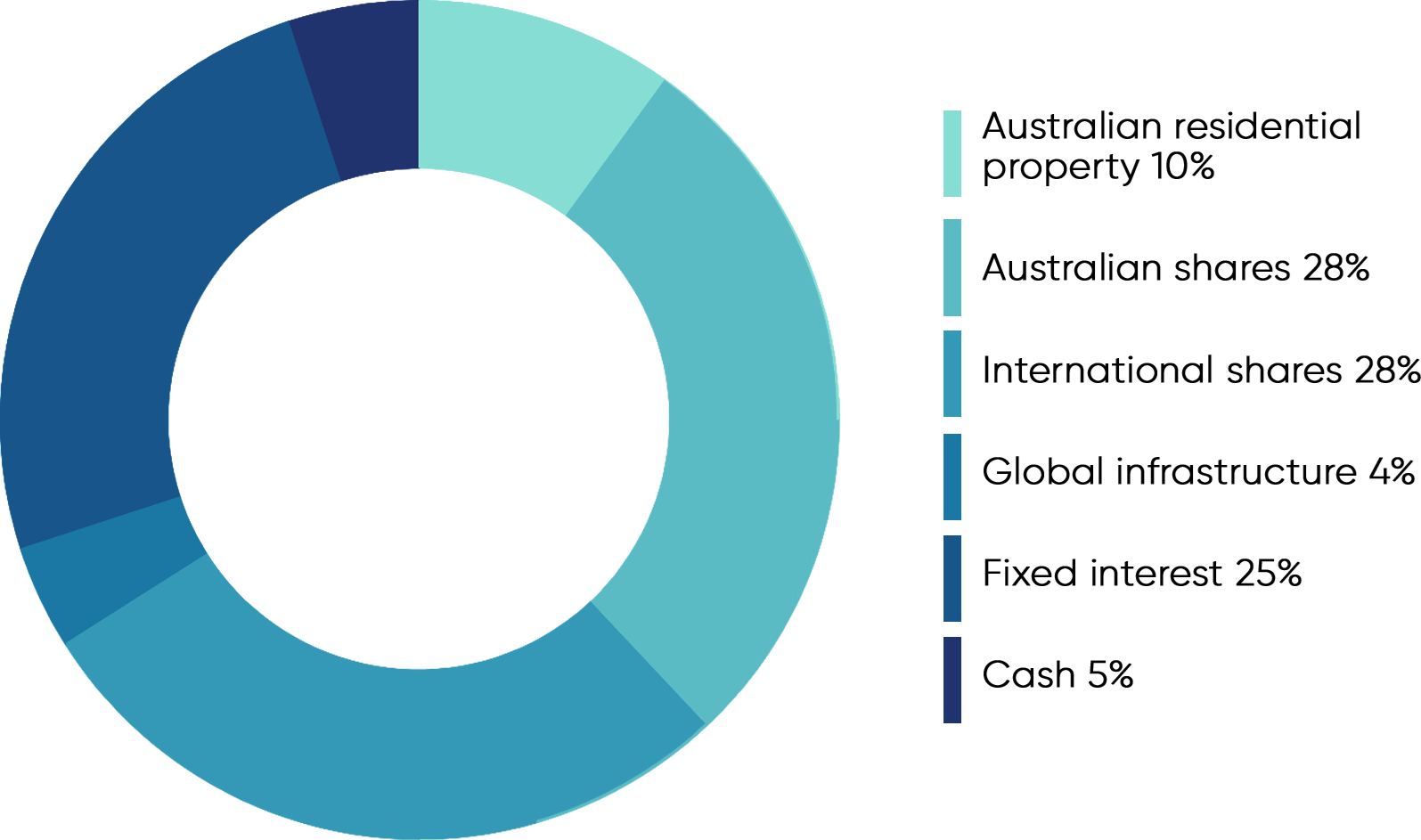

Balanced Essentials is a low fee investment option that lets members have 10% of their super invested in our property portfolio.

Fee comparison is based on information provided by SuperRatings. For full details on how our fees compare, check out the details here.

Want to sign up to a low fee super option?

*This is based on research conducted by SuperRatings Pty Ltd (AFSL No. 311880) at the request of Superestate which compared 376 balanced investment options using data current as at 31 Oct 2020.

BALANCED ESSENTIALS

This option suits those who are seeking growth but who wish to lower the risk of rapid changes in value over the short term. This option is designed to provide comparable levels of risk to the Balanced Property option and lower levels of risk than the Growth Property option, which may in turn produce lower levels of returns.

Investment Strategy

Superestate Balanced Essentials has a significant bias towards growth assets, such as Australian residential property, Australian and international shares with an offsetting allocation towards defensive assets such as fixed interest securities and cash.

Investment Objective

The Superestate Balanced Essentials investment option aims to outperform CPI + 2.0% over rolling 10-year periods

Minimum suggested time horizon: 7

Years

Level of investment risk:

6

Risk Label: High

Probability

of a negative return: 4 to less than 6

in 20 years

Investment fee: 0.214% pa

Admin

fee: 0.24% pa + $1.27 per week

Buy/Sell

Spread: 0.53%/0.29%

Indirect Cost

Ratio: 0.011% pa

These asset allocations may not be reflected in a particular portfolio at the time when you are selecting an investment option due to a possible temporary deviation from the stated asset allocations in these investment options.

Like most young people I thought investing in properties would always be out of reach – now I don’t need to worry!

- Lindsay, Start-up Representative

My super’s going to be invested for the next 30+ years and I love the idea of having some of this money invested in real residential property

- James, Accountant

I work in finance and even I don’t want all my super in the stock market! Happy my super now has a home

- Lucy, Financial Market Trader

Since I joined Superestate I love watching my super grow knowing that I'm preparing for my future through investments I understand.

- Dee, Real Estate Agent

Superestate found all my lost super for me, in the end I was surprised how much I had

- Igor, IT Engineer